- Solution

- Products

Products All Menu View

- Function

- Product/Service

- ONE AI

- OmniEsol

- Amaranth 10

- WEHAGO

- WEHAGO H

- IDC

- The Porter zone

- GEN AI DEWS

- MES

- Amaranth 10 UC

- WEHAGO T

- WEHAGO V

- Cloudserver

- Factoring

- Insight OFUS

- EFIS

- Argos EIM

- Smart A 10

- Medical Big Data Platform

- Cloudfax

- Electronic Tax Invoice

- ICS

- Argos EDM

- NAHAGO

- Certified E-Document

- Smart Works v4.0

- Local Government Digital Civic Administration Service Platform

- iCUBE

- iCUBE G20

- Bizbox Alpha

- WE Builder

- Smart A 2.0

- ERP 10

- Company

- Media

- Investors

- Solution

- Products

- Function

- Product/Service

- ONE AI

- GEN AI DEWS

- Insight OFUS

- OmniEsol

- MES

- EFIS

- ICS

- Amaranth 10

- Amaranth 10 UC

- Argos EIM

- Argos EDM

- WEHAGO

- WEHAGO T

- Smart A 10

- NAHAGO

- WEHAGO H

- WEHAGO V

- Medical Big Data Platform

- Certified E-Document

- IDC

- Cloudserver

- Cloudfax

- Smart Works v4.0

- The Porter zone

- Factoring

- Electronic Tax Invoice

- Local Government Digital Civic Administration Service Platform

- iCUBE

- iCUBE G20

- Bizbox Alpha

- WE Builder

- Smart A 2.0

- ERP 10

- Company

- Media

- Investors

- KOR

- Solution

All menu

Products

DOUZONE ICT GROUP provides ICT services that lead enterprise informatization.

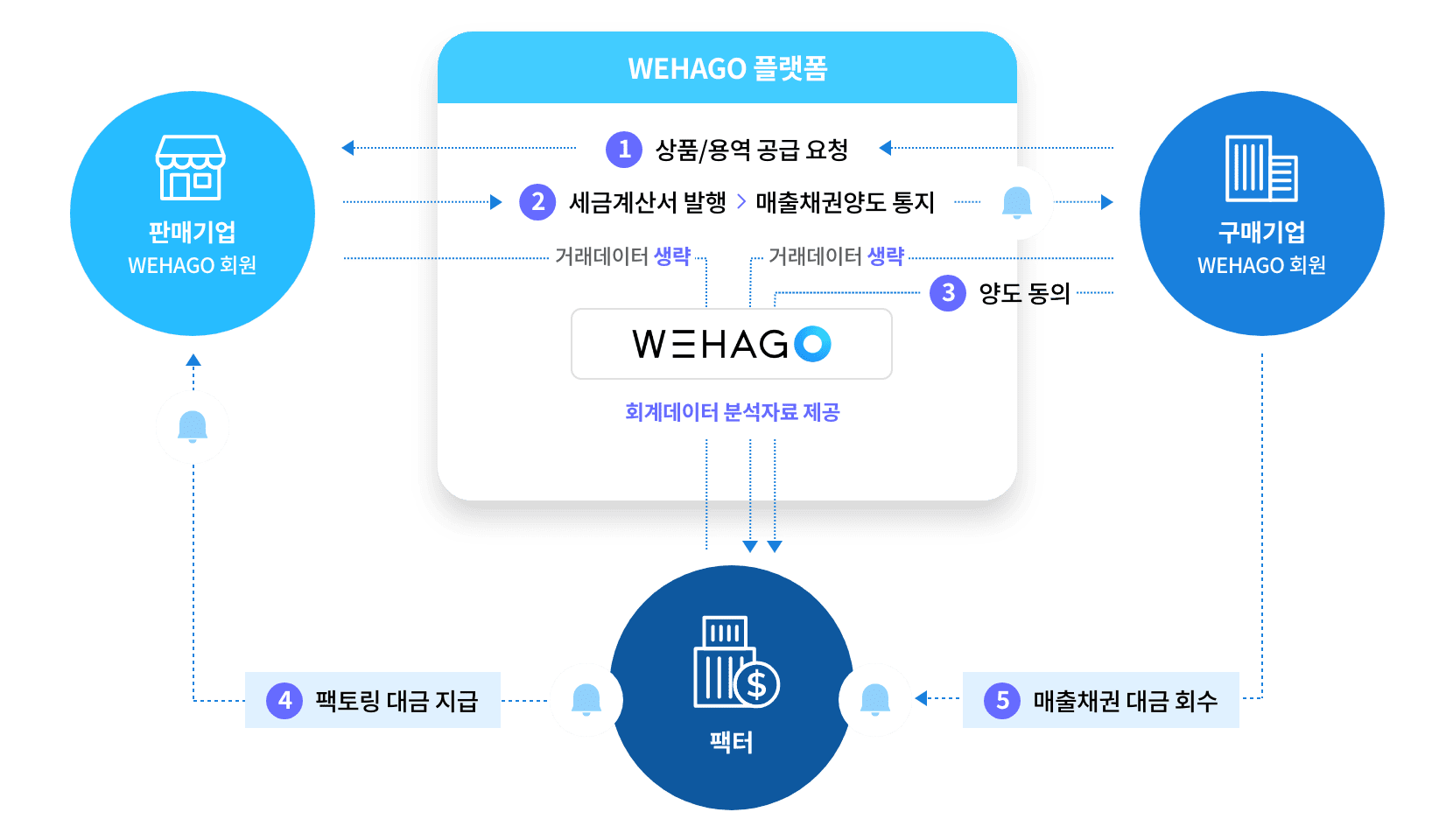

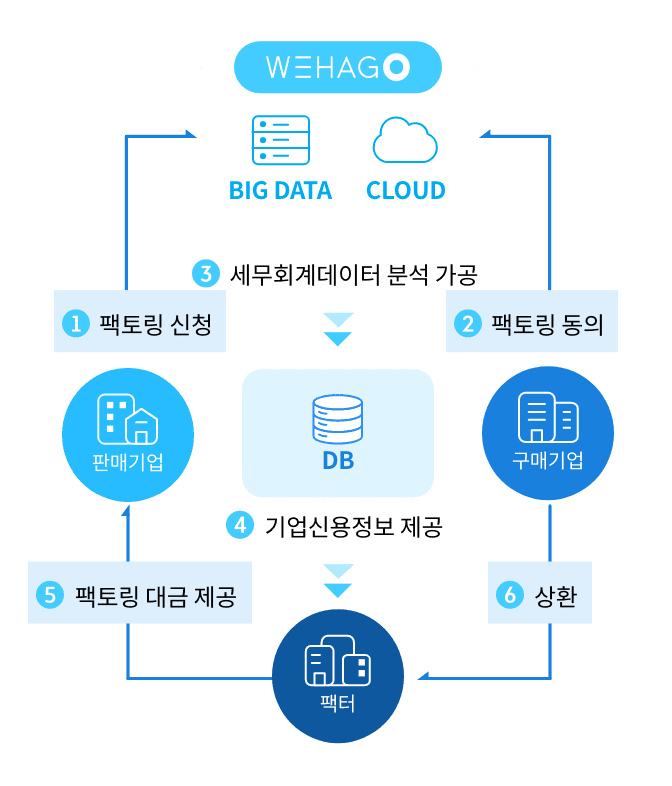

WEHAGO Account Receivable Factoring useful for businesspeople who are in need of cash

Your sales are yet to be recovered. Meanwhile, payrolls and bills are due, but it takes time to take out a loan.

Now, You can resolve this problem with WEHAGO Account Receivable Factoring.

Don't wait to recover sales and focus on scaling my business without a struggle.

Now, You can resolve this problem with WEHAGO Account Receivable Factoring.

Don't wait to recover sales and focus on scaling my business without a struggle.

WEHAGO Account Receivable Factoring useful for businesspeople

who are in need of cash

who are in need of cash

Account Receivable Factoring Distinct Advantages

Recommended for

Any business type that issues tax receipts are eligible to apply for account receivable factoring

- Manufacturing

- Agriculture

- Forestry

- Fisheries

- Mining

- Wholesale

- Retail

- Transportation

and Warehousing - Telecommunications

- Restaurants

- Lodging

- Professional

and Scientific - Technical and

Services

Benefits

Provides the "vendor" an option to quickly recover the amount they are owed, while the "purchaser" can have the time to pay the amount off.

All these services can be used with only a few clicks of buttons on the online platform

All these services can be used with only a few clicks of buttons on the online platform

purchasing consultation

1688

5000

5000