- Solution

- Products

Products All Menu View

- Function

- Product/Service

- ONE AI

- OmniEsol

- Amaranth 10

- WEHAGO

- WEHAGO H

- IDC

- The Porter zone

- GEN AI DEWS

- MES

- Amaranth 10 UC

- WEHAGO T

- WEHAGO V

- Cloudserver

- Factoring

- Insight OFUS

- EFIS

- Argos EIM

- Smart A 10

- Medical Big Data Platform

- Cloudfax

- Electronic Tax Invoice

- ICS

- Argos EDM

- NAHAGO

- Certified E-Document

- Smart Works v4.0

- Local Government Digital Civic Administration Service Platform

- iCUBE

- iCUBE G20

- Bizbox Alpha

- WE Builder

- Smart A 2.0

- ERP 10

- Company

- Media

- Investors

- Solution

- Products

- Function

- Product/Service

- ONE AI

- GEN AI DEWS

- Insight OFUS

- OmniEsol

- MES

- EFIS

- ICS

- Amaranth 10

- Amaranth 10 UC

- Argos EIM

- Argos EDM

- WEHAGO

- WEHAGO T

- Smart A 10

- NAHAGO

- WEHAGO H

- WEHAGO V

- Medical Big Data Platform

- Certified E-Document

- IDC

- Cloudserver

- Cloudfax

- Smart Works v4.0

- The Porter zone

- Factoring

- Electronic Tax Invoice

- Local Government Digital Civic Administration Service Platform

- iCUBE

- iCUBE G20

- Bizbox Alpha

- WE Builder

- Smart A 2.0

- ERP 10

- Company

- Media

- Investors

- KOR

- Solution

All menu

Products

DOUZONE ICT GROUP provides ICT services that lead enterprise informatization.

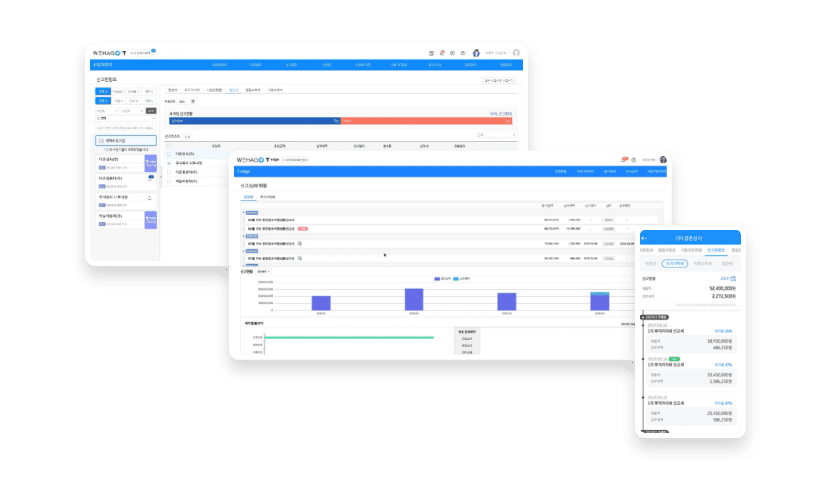

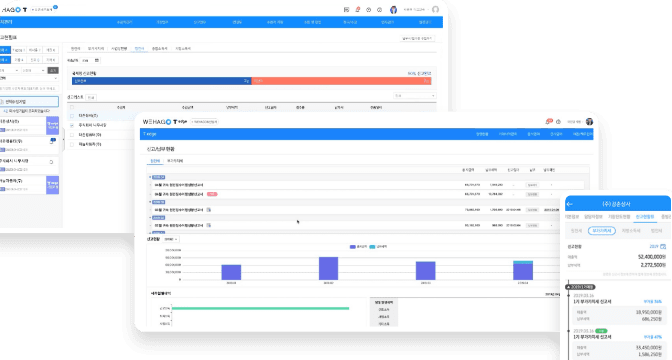

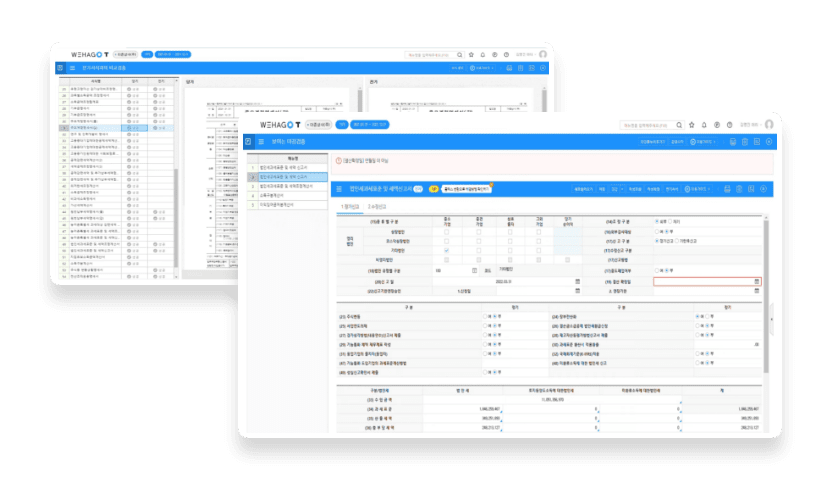

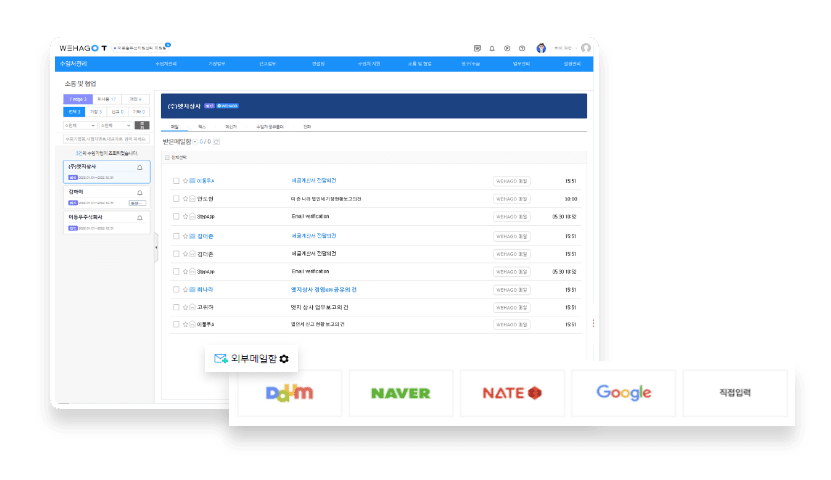

WEHAGO T ERP dedicated to accounting offices striving for

innovative work environment in an accounting office

WEHAGO T for accounting offices provides support across a range of activities between accounting offices and their clients.

The software not only supports record keeping and tax reporting but also communication, collaboration, document affairs, client management,

client management information services, consulting business, funds financing support, and receivable recovery support.

Moreover, even clients not enrolled in business management services can be connected via T edge to manage the client and allows to manage of

the employees of the client through NAHAGO.

The software not only supports record keeping and tax reporting but also communication, collaboration, document affairs, client management,

client management information services, consulting business, funds financing support, and receivable recovery support.

Moreover, even clients not enrolled in business management services can be connected via T edge to manage the client and allows to manage of

the employees of the client through NAHAGO.

The beginning of easy tax management, WEHAGO T

for Tax Accounting Offices

WEHAGO T Basic Module

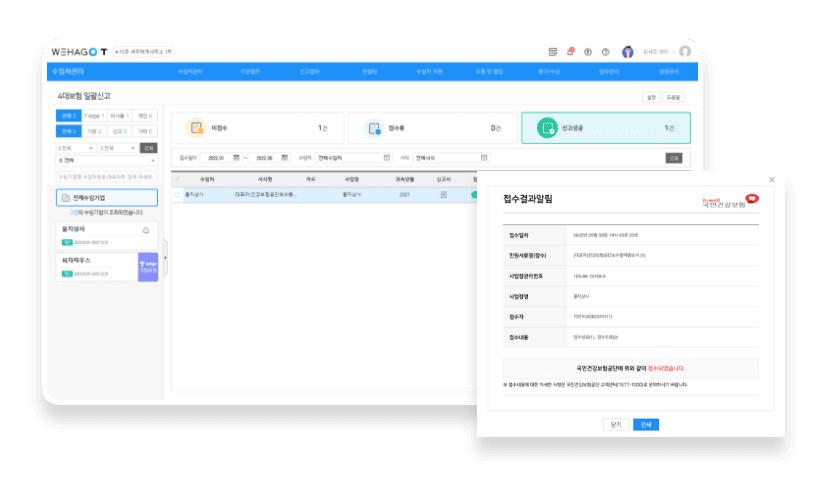

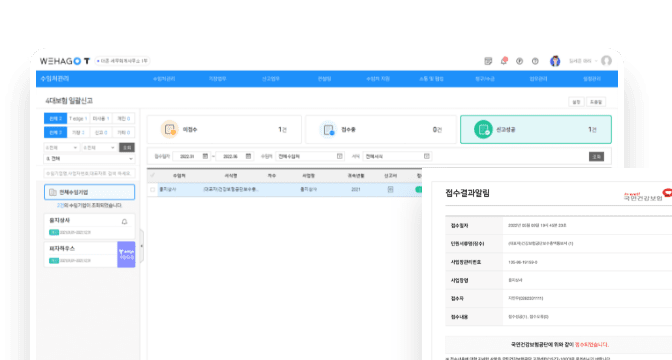

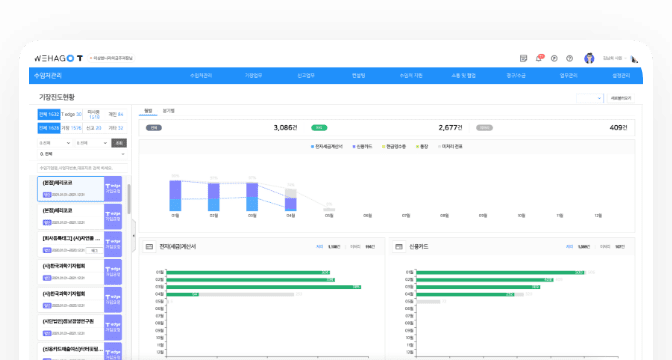

- Bookkeeping and Tax Reporting

-

- Financial Accounting, VAT reporting

- Corporate and Tax Reporting

Management - Eligible Evidence Automatic Collection & Manual Collection Functions

- Batch Transmission of 4 major social insurances and management of receipts

- Payroll Management and

Witholding Tax Reporting - Payroll Direct Deposit

- Validating Report Form entries

(MRI Function)

-

- Organizational Charts

- Company Bulletin

- Scheduling Management

- Facsimile

- Work Item Management

- Web Storage

- Messenger

- Web Office & ONEOFFICE

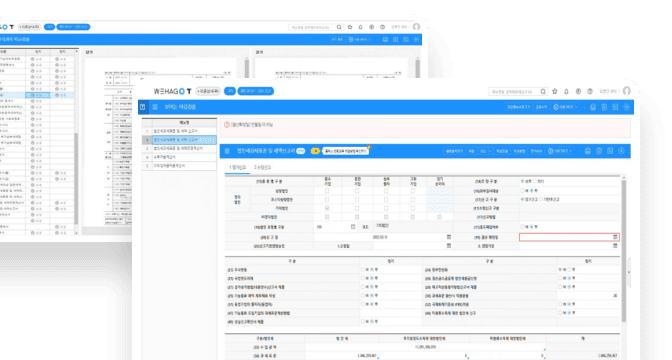

- Consulting/Fund Management

-

- Business Analysis Report

- Account Receivable Factoring

- Service Market

-

- Corporate Credit Card

- Individual Credit Card

- Electronic Authorization

- Work Hour Management

Client Management

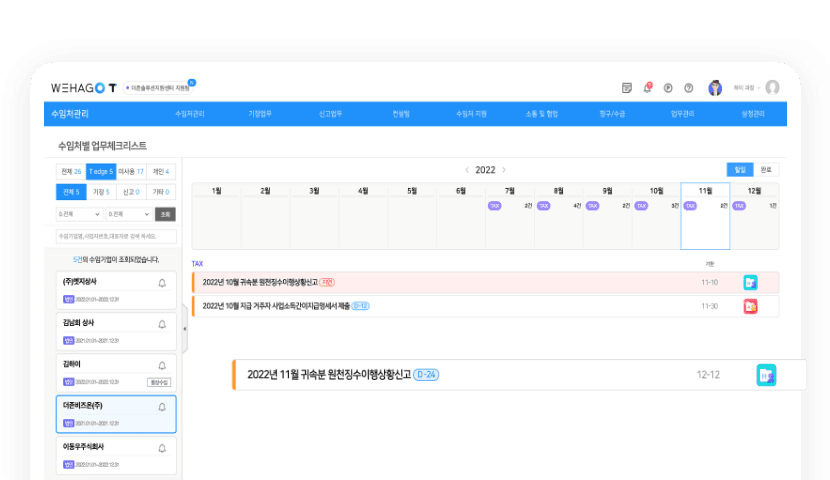

- Work Management

-

- Client Status

- Bookkeeping progress

- Payment Management

(Invoicing and CMS Management) - Time Machine Restoring Smart A 10 Data

- Reporting Status

- Work Item Checklist by Client

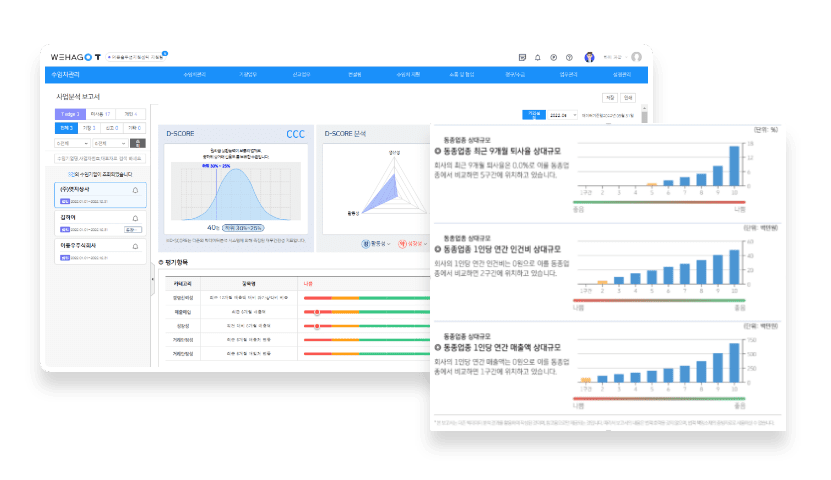

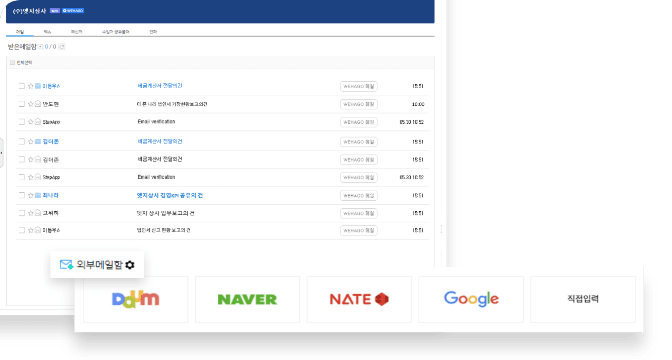

- T edge Connection Service (Free of Charge)

-

- Hometax, Card Issuers, etc.

- Credit Card Sales Payout schedules

- Document Issuance Duties

Communication - Collected Information Registry

Real-time sharing - Receivables Recovery Support

- Evidence Image Collection

Communication - Sales and Purchasing Information Collection Status

- Work Communication through

Messengers, e-mails, facsimille - Document Storage

- Claims and Liabilities Management

- Personnel and Payroll Management

- Notices

- NAHAGO (Free of Charge)

-

- Wage (Salary) Statement Transmission

- Income Data Collection

- Client tax returns

- Untact Consolidated Income Tax Reporting

- Civil Complaint forms other forms

- Freelancer Reporting Management

- Hometax representative registration/consent

WEHAGO T Distinctive Advantages

Recommended for

ERP dedicated for Tax and Accounting Offices, most popular among the businesses that provide agency services in Bookkeeping,

social insurance reporting and tax reporting.

social insurance reporting and tax reporting.

- Tax Accounting Office

- Labor Attornies

Benefits

Bookkeeping duties can be performed anywhere at any time accessing the cloud-based platform.

You can perform any reporting duties with WEHAGO T.

You can perform any reporting duties with WEHAGO T.

purchasing consultation

1688

5000

5000